Oil & Gas Market Size to Surpass USD 8.79 Trillion by 2034

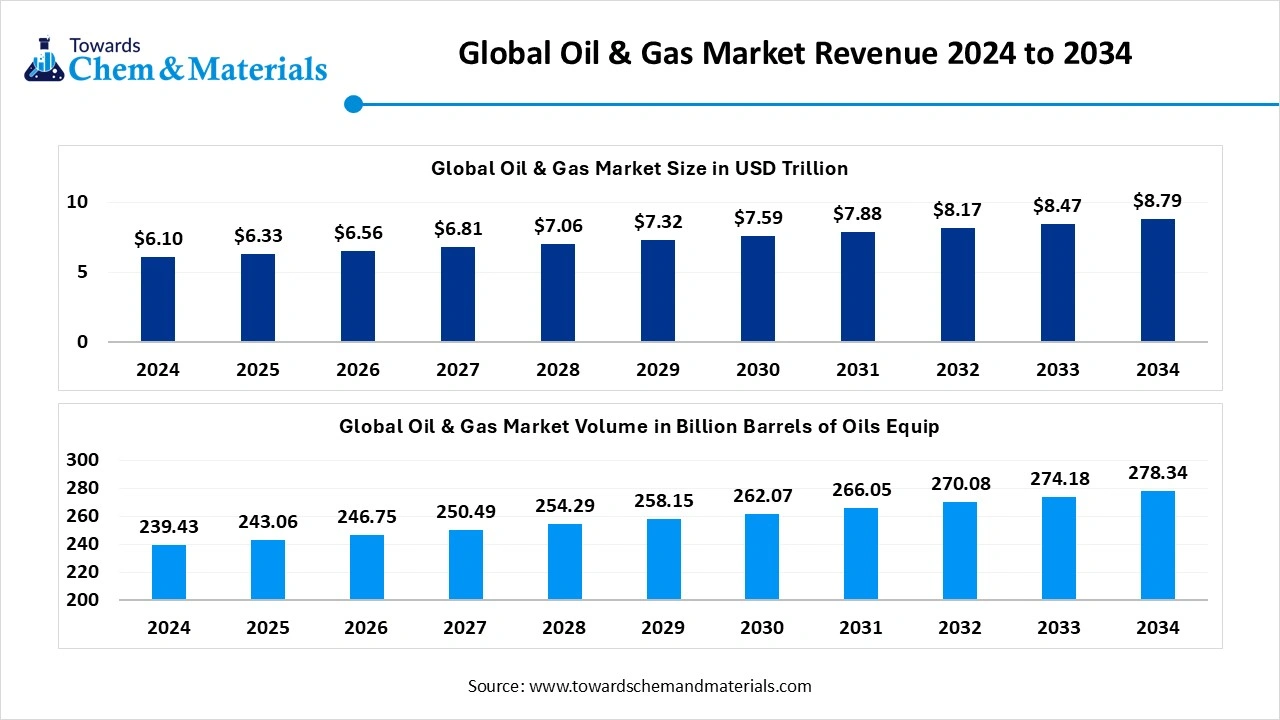

According to Towards Chemical and Materials, the global Oil & Gas market size was estimated at USD 6.10 Trillion in 2024 and is expected to surpass around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034.

Ottawa, Aug. 14, 2025 (GLOBE NEWSWIRE) -- According to an exclusive Report, the global oil & gas market volume is calculated at 239.43 billion barrels of oils equi in 2024, grew to USD 243.06 billion barrels of oils equi in 2025, and is projected to reach around 278.34 billion barrels of oils equi by 2034. The market is expanding at a CAGR of 1.52% between 2025 and 2034. In 2024 Asia Pacific led the market, achieving over 37.14% share with a revenue of 88.92 billion barrels of 0ils equi

The global oil & gas market size was valued at USD 6.10 Trillion in 2024, grew to USD 6.33 Trillion in 2025, and is expected to hit around USD 8.79 Trillion by 2034, growing at a compound annual growth rate (CAGR) of 3.72% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5739

Oil & Gas Market Overview

The market is expanding with the growing global energy demand in emerging markets, continued investment in upstream, LNG, and infrastructure, and increased productivity through technical innovation.

The oil & gas market includes the exploration, extraction, refining, transportation, and marketing of products derived from crude oil and natural gas that are used as fuels or raw materials in a variety of industries. The market operates with variable crude oil prices in conjunction with extraneous external factors including political activity and international relations, while also seeing volatility in energy policies that incorporate renewable energy and sustainability. Likewise, technological advancements in offshore drilling and shale extraction are growing supply. Demand is driven by economic growth and industrialization and requires large quantities of oil and gas for transportation. The Asia Pacific region has been at the forefront of consumption growth. Efforts to 'transition' from fossil-fuels to cleaner energy sources are changing the sector in a significant way; however, legacy energy markets, such as oil and gas, will still be important for global energy security and petrochemical production.

Oil & Gas Market Report Highlights

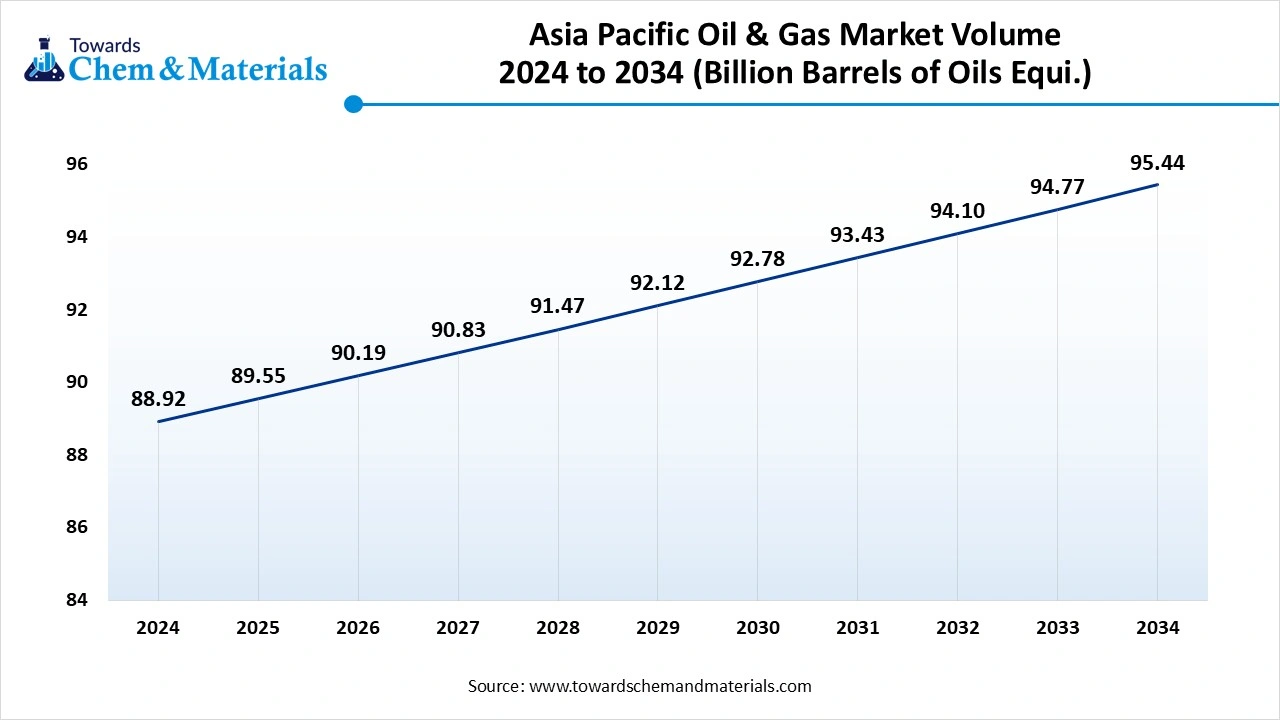

- The Asia Pacific oil and gas market size was estimated at 88.92 Billion Barrels of Oils Equi. in 2024 and is projected to reach 94.77 Billion Barrels of Oils Equi. by 2034, growing at a CAGR of 0.71% from 2025 to 2034.

- Asia Pacific dominated the oil and gas market and accounted for the largest revenue share of over 37.14% in 2024.

- The Oil and Gas market in North America is projected to grow at the fastest CAGR of 26.12% over the forecast period. owing to the sudden increase in demand for energy for heavy applications in recent years.

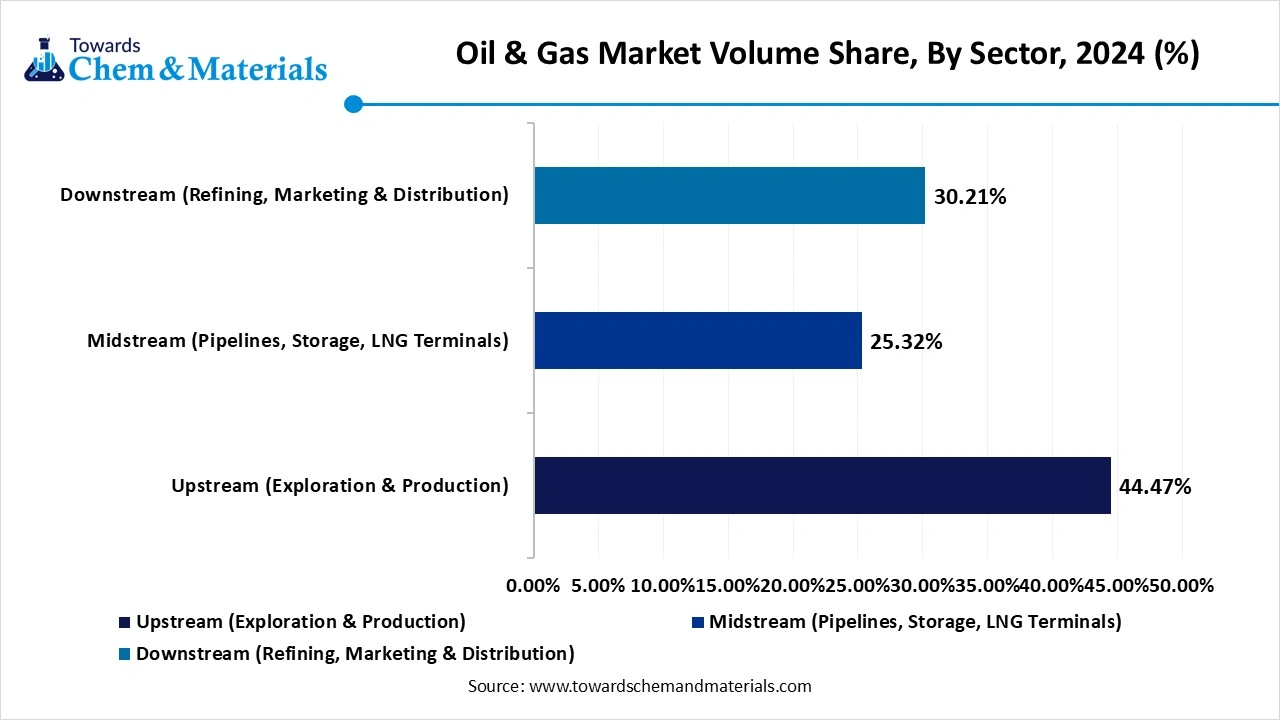

- By sector type, the upstream segment is expected to grow at the fastest rate in the market during the forecast period, akin to increased discoveries of new basins and untapped reserves in the past few years.

- By sector type, the Upstream (Exploration & Production) segment dominated the market with the largest volume share of 44.47% in 2024.

- By sector type, the Downstream (Refining, Marketing & Distribution) segment is projected to grow at the fastest CAGR of 2.73% over the forecast period by 2025-2034.

- By resource type, the LNG segment is expected to lead the market in the coming years, due to the sudden increased need for cleaner fuel than coal and oil in recent years.

- By extraction technique, the onshore drilling segment led the market in 2024 with 50% market share, due to having unique properties such as the easier, cost-effective & considered more common than the offshore drilling

- By extraction technique, the unconventional segment is expected to capture the biggest portion of the market in the coming years, because the unconventional methods have succeeded in finding new sources of oil and gas, which were previously seen as difficult to extract.

- By end use, the transportation segment led the market in 2024 with 40% industry share, because it is the most efficient and widely used method for producing ATH from bauxite.

- By end use, the petrochemical manufacturing segment is expected to grow at the fastest rate in the market during the forecast period, because most of the oil produced is used to power vehicles.

- By deployment type, the onshore segment led the market in 2024 with 60% industry share, because most oil and gas equipment and facilities, like drilling rigs and refineries, are located on land.

- By deployment type, the subsea segment is expected to capture the biggest portion of the market in the coming years, because more oil and gas fields are being discovered in deep waters.

- By technology type, the hydraulic fracturing segment led the oil & gas market in 2024 with 35% industry share, because it made it possible to extract oil and gas from shale and tight rock formations.

- By technology type, the AI & Predictive maintenance segment is expected to grow at the fastest rate in the market during the forecast period, because it helps oil and gas companies prevent breakdowns and improve efficiency.

- By distribution channel, the direct supply segment led the market in 2024 with 52% industry share, because large buyers like power plants, refineries, and industries prefer to get oil and gas directly from producers.

- By distribution channel, the oilfield services companies’ segment is expected to grow at the fastest rate, because producers are outsourcing more work to specialized experts.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5739

Oil & Gas Market Report Scope

| Report Attribute | Details |

| Market size / Volume in 2025 | USD 6.33 Trillion / 278.34 Billion Barrels of Oils Equi. |

| Expected size / Volume by 2034 | USD 8.79 Trillion / 278.34 Billion Barrels of Oils Equi. |

| Growth rate | CAGR of 1.52% from 2025 to 2034 |

| Actual data | 2020- 2024 |

| Forecast period | 2025 - 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Sector, By Resource Type, By Extraction Technique, By End Use, By Deployment Type, By Technology, By Distribution Channel, By Region |

| Key companies profiled | ExxonMobil Corporation, Royal Dutch Shell Plc, Chevron Corporation, BP Plc , TotalEnergies SE , Saudi Aramco, PetroChina Co. Ltd. , Gazprom , Equinor ASA , ENI S.p.A., ConocoPhillips , Rosneft Oil Company , Schlumberger Ltd. , Halliburton Company, Baker Hughes Company , China National Offshore Oil Corporation (CNOOC) , Lukoil PJSC , Occidental Petroleum Corporation (Oxy), Woodside Energy Group Ltd. , Reliance Industries Limited (RIL) |

Elevate your Chemical strategy with Towards Chemical and Materials. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardschemandmaterials.com/schedule-meeting

Oil & Gas Market Major Trends

- Rise of Non-traditional Resources- The advancements in horizontal drilling and hydraulic fracturing have opened shale oil and gas resources, providing an increase in supply, a diversification of supply sources, and altered the global energy landscape, also mainly in Canada and the United States.

- Energy Transition and Decarbonization- The focus on reducing carbon emissions has driven companies to utilize cleaner fuels, debate carbon capture, and how renewable fuels can be integrated diminishing the oil and gas companies long-term strategies in energy sustainability.

- Digitalization and Automation- The application of artificial intelligence, the Internet of Things, and big data analytics are enhancing exploration accuracy, optimizing production, and improve safety and efficiency across the end-to-end oil and gas supply/value chain.

- Geopolitical and Supply Chain Disruptions- Ongoing political tensions, trade disputes, and continue with disruption to crude oil pricing and supply stability and the need for diversification of supply sources and management of strategic reserves.

How AI Transforms the Oil & Gas Market Smarter, Safer, and More Sustainable?

Artificial Intelligence is making its mark on oil & gas operations and is improving efficiency, safety, and sustainability. British Petroleum (BP) is utilizing AI algorithms to improve accuracy in its oil and gas exploration capabilities. AI analyses large quantities of geological data and optimizes drilling operations, which can create more precise and efficient extraction methods.

-

In July 2025, Donald Trump announced a US$70 billion investment in artificial intelligence and energy at the Pennsylvania Energy and Innovation Summit, gathering prominent players in the oil and tech sectors.

AI is using machine learning models to enhance drilling operations, use predictive analysis to optimize preventative maintenance schedules to reduce equipment failure, and improve reservoir management and reduction of resource waste.

The oil and gas industry is evolving with smarter solutions using artificial intelligence to create advanced functioning models of their operations while improving sustainability and positioning themselves for future challenges and opportunities.

Oil & Gas Market Dynamics

Growth Factor

Soaring Oil & Gas Demand Contributing to a New Era of Market Expansion?

The most significant underlying driver in the oil & gas market is the appetite/growth in demand for energy. The IEA states that oil demand growth for Q1 2025, is projected at 990 kb/d, to 650 kb/d, still, that indicates a healthy consumption trend.

At the same time, natural gas demand rose 2.7% in 2024, around 115 billion cubic meters, and had the highest growth of all fossil fuels. This growth has been mostly due in part to strong power generation driven by extreme weather events and increased global industrial consumption.

Further, global upstream oil and gas investment increased by 7% in 2024 to reach USD 570 billion, following a 9% increase in 2023. The activity for a lot of the activity, is not only meant to fill immediate demand, but strategically, to strengthen the resilience of supply chains, increase energy security, and position the sector for shocks in consumption in the future. With oil and gas demand on a steady trend, will be at the center of most growth strategies in the road ahead.

Market Opportunity

Could Global CCS and Low-Carbon Hydrogen Propel the Next Wave of Growth for Oil & Gas?

An important global opportunity for the oil and gas industry revolves around the creation and deployment of Carbon Capture, Utilization and Storage (CCUS) technologies alongside low-carbon hydrogen development. There are over 45 commercial-scale CCUS plants operating globally, with carbon capture capacity for 2030 increased by 35% which will bring projected more than 435 million tonnes (Mt) CO2 per annum by 2030.

Major oil companies, for example, ExxonMobil, Chevron and QatarEnergy are all carrying out significant CCUS projects as part of this evolution. Further, in May 2025, Exxon recently committed to supply 250,000 metric tonnes of low-carbon ammonia per annum; showing the increasing commercial construction of hydrogen-enabled technologies.

The coexistence of CCUS infrastructure and hydrogen value chains shifts traditional, hard-to-abate fossil energy systems to carbon responsible energy conduits.

Market Challenges

- Price Volatility- Prices of oil and gas globally experience price volatility because of geopolitical tensions, supply-demand mismatches, and economic fluctuations. Price fluctuations stymie investment planning, degrade revenues by producers, and hinder long-term commitments to projects.

- Environmental Regulations- In light of governmental climate policies and emissions reduction targets, oil and gas producers are expected to lessen carbon footprint. To comply with these regulations and policies will raise the cost of production and, in some jurisdictions, either limit or prevent new exploration, production, or refining.

- Geopolitical Risks- Political instability, sanctions, and conflict in key producing regions, contribute to threats to supply security. The costs of trading supplies globally is affected by supply disruptions, resulting transportation is costlier than previous estimates, and foreign investors are deterred from peripheral investments in the value chain compose with an oil and gas supply chain.

- Transition to Renewables- The push for government to adopt renewable energy sources, combined with the growth of electric mobility will decrease long-term demand for fossil fuels. This energy transition presents challenges to the oil and gas industry's future growth opportunities and necessitates further strategic diversification.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Why is the Oil & Gas Market Dominated by Asia Pacific Region?

The Asia Pacific Oil and Gas market size is estimated at 88.92 Billion Barrels of Oils Equi in 2025 and is anticipated to 95.44 Billion Barrels of Oils Equi by 2034, growing at a CAGR of 0.71% from 2025 to 2034.

Asia Pacific dominated the market in 2024. The Asia Pacific region is characterised by high energy demand, large refining and petrochemical activity, and increasing LNG import terminal capacity. Governments in Asia Pacific faced the triple pressures of strong industrialisation, urbanisation, and power generation demand to maintain deliveries and consumption while balancing energy security with transition planning. Investment in storage, pipelines, and terminals has now entrenched APAC's critical position in developing and maintaining trade flows and project activity.

Oil & Gas Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume – 2024 (Billion Barrels of Oils Equi.) | Market Volume - 2034 (Billion Barrels of Oils Equi. | CAGR (2025 - 2034) | Volume Share, 2034 (%) | |||

| North America | 25.12 | % | 60.14 | 72.70 | 2.13 | % | 26.12 | % |

| Europe | 12.32 | % | 29.50 | 34.79 | 1.85 | % | 12.50 | % |

| Asia Pacific | 37.14 | % | 88.92 | 94.77 | 0.71 | % | 34.05 | % |

| South America | 7.12 | % | 17.05 | 22.60 | 3.18 | % | 8.12 | % |

| Middle East & Africa | 18.30 | % | 43.82 | 53.47 | 2.24 | % | 19.21 | % |

| Total | 100.00 | % | 239.43 | 278.34 | 1.52 | % | 100.00 | % |

Why Is China A Leading Country In Asia Pacific?

China's integrated energy system extensive refining sector, petrochemical feedstock demand, and increasing LNG import capability makes it the centre of oil and gas activity in APAC. The current government policy has promoted the development of infrastructure to support industrial capacity expansions, storage development projects, and cross-border trade links resulting in continued substantial upstream, midstream, and downstream activity.

-

In March 2025, China National Offshore Oil Company (CNOOC) is set to launch an upgraded oil refinery complex capable of producing 120,000 barrels of refined product per day, adding to the region's refining and import capabilities with crude processing capacity rise by 50% to 240,000 bpd.

| Top 10 Oil-Producing Countries 2024 (Tonnes) | Top 10 Natural Gas Producing Countries 2024 (M^3) | ||

| United States | 858M | United States | 1T |

| Russia | 526M | Russia | 629.9B |

| Saudi Arabia | 510M | Iran | 262.9B |

| Canada | 290M | China | 248.4B |

| Iran | 234M | Canada | 194.2B |

| Iraq | 216M | Qatar | 179.5B |

| China | 213M | Australia | 150.1B |

| Brazil | 182M | Saudi Arabia | 121.5B |

| United Arab Emirates Flag | 180M | Norway | 113.2B |

| Kuwait | 131M | Algeria | 94.7B |

Why Is North America The Fastest-Growing Oil & Gas Market In The Forecast Period?

North America expects the fastest growth in the market during the forecast period. North America's growth is driven by advances in technology for shale development, abundant access to unconventional resources, and new LNG export facilities. The abundance of private capital, the number of M&A opportunities, and the pace of new pipelines and export terminals has changed supply dynamics, allowing the region to scale production and compete in global markets. The continued support of policies and infrastructure projects benefitting North American expansion will allow, for some time, continued growth in the near term.

What Drives The United States As The Regional Leader?

The United States, led by prolific basins and services ecosystem deep, is leading the expansion of North America. High-impact basins, changing well designs and a dense midstream network facilitate quick commercialisation of shale discoveries. In 2024, natural gas accounted for around 38% of the U.S. total energy production, representing the largest share of domestic energy production each year. Similarly, domestic crude oil accounted for around 27% of U.S. energy production in 2024, while actively remaining the world's largest producing crude oil country; this continues to bolster the U.S. role as a global energy leader.

Oil & Gas Market Segmentation

Sector Type Insights

Why is Upstream Sector Segment Dominated the Oil & Gas Market in 2024?

The upstream segment led the oil & gas market in 2024 due to the global demand for energy. The upstream sector benefits from advanced drilling technologies, resource-rich areas getting more investment, and increasing crude oil usage. Onshore drilling and hydraulic fracturing will solidify its market presence by maintaining direct supply channels that permit effective operations and predictable cash flows into downstream sectors.

The midstream segment is expected to grow at a notable rate during the predicted timeframe due to a sudden increase in the need for transportation, processing of oil and gas, and storage worldwide. Furthermore, the several countries energy demand has increased, and countries are actively investing in the mid streams than just drilling, which is likely to create huge opportunities for the segment in the upcoming years.

Oil & Gas Market Volume Share, By Sector Insights, 2024-2034 (%)

| By Sector | Volume Share, 2024 (%) | Market Volume – 2024(Billion Barrels of Oils Equi.) | Volume Share, 2034 (Billion Barrels of Oils Equi.) | CAGR (2025 - 2034) | Volume Share, 2034 (%) | |||

| Upstream (Exploration & Production) | 44.47 | % | 106.47 | 104.54 | -0.20 | % | 37.56 | % |

| Midstream (Pipelines, Storage, LNG Terminals) | 25.32 | % | 60.62 | 81.61 | 3.36 | % | 29.32 | % |

| Downstream (Refining, Marketing & Distribution) | 30.21 | % | 72.33 | 92.19 | 2.73 | % | 33.12 | % |

| Total | 100.00 | % | 239.43 | 278.34 | 1.52 | % | 100.00 | % |

Resource Type Insights

Why does the Crude oil Segment Dominate the Oil & Gas Market in 2024?

Crude oil segment accounted for the largest resource type in the oil & gas market in 2024, with its large usage in transportation fuels, power generation, and petrochemical production provided support. Crude oil’s dominance relies on solid demand internationally and strong, reliable supply infrastructure.

The LNG segment is forecast to grow the fastest in the coming years, driven by increased use of cleaner fuels, expanding LNG export-import infrastructure, and demand from developing economies. Advances in technology in the liquefaction and regasification processes are also favourably positioned LNG in the global energy mix.

Extraction Technique Insights

Which Extraction Technique Segment Held the Largest Share in the Oil & Gas Market in 2024?

The onshore drilling segment dominated the oil & gas market under the category of extraction techniques as it is low capital and normalized risk nature of investment and ability to use at scale. Established infrastructure and limited risk means that exploration and production companies often favour this method.

The unconventional sector segment is expected to have the fastest growth during forecasted period, with increased unconventional developments of shale gas and tight oil. These developments can be approved because of the new advancements in technologies such as hydraulic fracturing and the ability to implement host of new jobs to extract oil and gas with greater recovery rates, with more efficiency and from challenging geological basins.

End Use Insights

Which End User Segment Dominated The Oil & gas market in 2024?

The transportation segment led the oil & gas market in end use in 2024 as the global dependence on petroleum-based fuels continued for road, air, and marine transportation. The fleet size of road vehicles was increasing, freight movement was on the rise, and aviation networks were expanding which all stimulated the ongoing demand for this segment.

The petrochemical manufacturing segment is growing at fastest CAGR during forecasted period, with increasing demand for plastics, fertilizers, and other chemical derivatives. The opportunities for growth in this segment which spans developed and emerging markets are supported by continuing advancements in refining technologies and the ongoing supply of crude oil.

Deployment Type Insights

Which Deployment Type Segment Dominated the Oil & gas market in 2024?

The onshore deployment segment dominated the oil & gas market in 2024, primarily due to cost-effectiveness, longer lifespan, and allowance for greater operations with a lower cost of investment in infrastructure costs than offshore production systems. Onshore facilities are also easier to access, logistical limits are not as apparent, and projects can generally be executed in a shorter timeline.

The subsea deployment segment expect the fastest growth in upcoming period, due to the discovery of deepwater reserves, new investments in offshore exploration, and advancements in subsea production systems to remove resources in difficult submerged environments.

Technology Insights

Why the Hydraulic Fracturing Technology Segment Dominated the Oil & gas market in 2024?

The hydraulic fracturing technology segment dominated the market in 2024, largely due to its success in unlocking reserves from tight formations and improving production. It has become a leading option to maximize output from aging fields and unconventional reserves.

The artificial intelligence & predictive segment maintenance was projected to have the fastest growth, as operators are using more advanced analytics, real-time monitoring, and predictive tools/technology to improve equipment performance, reduce downtime, and decrease operational costs. Increasing digital technology uptake is changing the way that operational strategies are carried out in the oil and gas value chain.

Distribution Channel Insights

Which Distribution Channel Held the Largest Share in the Oil & Gas Market in 2024?

The direct supply segment dominated the distribution channel segment of oil & gas market in 2024, as it offered cost savings, quicker delivery time, and stronger relationships between suppliers and buyers. Through direct supply, two parties avoid third-party intermediaries, allowing the producer to control pricing, quality, and delivery to the end user. This is especially important in the context of oil and gas delivery for large industrial and energy applications.

The oilfield services segment will continue to grow at the fastest rate in the upcoming years. The growth will be attributed to increased demand for specialized technical expertise, maintenance, and operational support, which are increasingly important for enhancing productivity and extending the lifespan of oil and gas assets.

You can place an order or ask any questions, please feel free to contact at sales@towardschemandmaterials.com| +1 804 441 9344

More Insights in Towards Chemical and Materials:

- Oil & Gas Infrastructure Market : The global oil & gas infrastructure market size was reached at USD 752.19 billion in 2024 and is expected to be worth around USD 1,377.87 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.24% over the forecast period 2025 to 2034.

- Industrial Oil Market : The industrial oil market volume accounted for 48,679.0 kilotons in 2024 and is predicted to increase from 50,139.3 kilotons in 2025 to approximately 65,420.4 kilotons by 2034, expanding at a CAGR of 3.00% from 2025 to 2034.

- Copper Foil Market : The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034.

- AdBlue Oil Market : The global adblue oil market size was accounted for 76.58 billion liters in 2024 and is expected to be worth around USD 148.37 billion liters by 2034, growing at a compound annual growth rate (CAGR) of 6.84% during the forecast period 2025 to 2034.

- Oleochemicals Market : The global oleochemicals market volume is calculated at 17.70 million tons in 2024, grew to 18.50 million tons in 2025, and is projected to reach around 27.50 million tons by 2034. The market is expanding at a CAGR of 4.50% between 2025 and 2034.

- Bio-Renewable Chemicals Market : The global bio-renewable chemicals market size was valued at USD 15.11 billion in 2024 and is growing to approximately USD 39.01 billion by 2034, with a developing compound annual growth rate (CAGR) of 9.95% over the forecast period 2025 to 2034.

- Natural Gas Market : The global natural gas market size accounted for USD 4.19 trillion in 2024 and is predicted to increase from USD 4.41 trillion in 2025 to approximately USD 6.96 trillion by 2034, expanding at a CAGR of 5.20% from 2025 to 2034.

- Renewable Natural Gas Market : The global renewable natural gas market size is calculated at USD 15.5 billion in 2025 and is forecasted to reach around USD 31.37 billion by 2034, accelerating at a CAGR of 8.15% from 2025 to 2034.

- Gas Separation Membrane Market : The global gas separation membrane market size was valued at approximately USD 1.85 billion in 2024 and is projected to grow at a CAGR of 6.95% from 2025 to 2034, reaching a value of USD 3.62 billion by 2034.

- Oil Spill Management Market : The global oil spill management market size was reached at USD 151.71 billion in 2024 and is estimated to surpass around USD 210.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.35% during the forecast period 2025 to 2034.

- Reusable Oil Absorbents Market : The global reusable oil absorbents market size was valued at USD 412.75 million in 2024. The market is projected to grow from USD 434.42 million in 2025 to USD 688.51 million by 2034, exhibiting a CAGR of 5.25% during the forecast period.

- Hydrogenated Vegetable Oil Market : The global hydrogenated vegetable oil market size accounted for USD 35.25 billion in 2024 and is predicted to increase from USD 37.84 billion in 2025 to approximately USD 71.64 billion by 2034, expanding at a CAGR of 7.35% from 2025 to 2034.

- Industrial Boiler Market : The global industrial boiler market size was reached at USD 17.11 billion in 2024 and is expected to be worth around USD 24.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.85% over the forecast period 2025 to 2034.

- Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

- Boiler Market : The global boiler market size was reached at USD 100.29 billion in 2024 and is expected to be worth around USD 199.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period 2025 to 2034.

- U.S. Specialty Oleochemicals Market : The U.S. specialty oleochemicals market size accounted for USD 4.23 billion in 2024 and is predicted to increase from USD 4.57 billion in 2025 to approximately USD 9.23 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- U.S. Oil & Gas Market : The U.S. oil & gas market size is calculated at USD 1.55 trillion in 2024, grew to USD 1.61 trillion in 2025, and is projected to reach around USD 2.24 trillion by 2034. The market is expanding at a CAGR of 3.75% between 2025 and 2034.

- U.S. Oil & Gas Infrastructure Market : The U.S. oil & gas infrastructure market size was reached at USD 78.85 Billion in 2024 and is expected to be worth around USD 147.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.45% over the forecast period 2025 to 2034.

- Asia Pacific Oil & Gas Infrastructure Market : The Asia Pacific oil & gas infrastructure market size accounted for USD 207.77 billion in 2025 and is forecasted to hit around USD 365.90 billion by 2034, representing a CAGR of 6.49% from 2025 to 2034.

- Europe Oil & Gas Infrastructure Market : The global Europe oil & gas infrastructure market size was reached at USD 85.11 billion in 2024 and is expected to be worth around USD 140.09 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034.

Oil & Gas Market Top Key Companies:

- ExxonMobil Corporation

- Royal Dutch Shell Plc

- Chevron Corporation

- BP Plc

- TotalEnergies SE

- Saudi Aramco

- PetroChina Co. Ltd.

- Gazprom

- Equinor ASA

- ENI S.p.A.

- ConocoPhillips

- Rosneft Oil Company

- Schlumberger Ltd.

- Halliburton Company

- Baker Hughes Company

- China National Offshore Oil Corporation (CNOOC)

- Lukoil PJSC

- Occidental Petroleum Corporation (Oxy)

- Woodside Energy Group Ltd.

- Reliance Industries Limited (RIL)

What is Going Around the Globe?

- In October 2024, TotalEnergies achieved a milestone in their global LNG bunkering network by commencing operations in their new strategic ports, enhancing supply options and supporting the maritime sector's transition to cleaner fuels.

- In February 2025, Brazilian state-run giant Petrobras signed a memorandum of understanding with India's Oil & Natural Gas Corporation (ONGC) to mutually explore and produce oil and gas, enhance fuel sales, advance decarbonization, and develop biofuels.

- In August 2025, Chevron formed a partnership with BCPR, a Bangchak Group affiliate and Thai energy company, on exploration and Production to exploit oil and gas exploration in Southeast Asia's block that will attempt to strengthen resource development in the region and support the planning of future energy supplies.

- In November 2024, The European Commission joined with Beyond Oil and Gas Alliance (BOGA) group to further accelerate their plan to phase out fossil fuels, switch to renewable energy alternatives, and implement a just energy transition globally.

Oil & Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Oil & Gas Market

By Sector

- Upstream (Exploration & Production)

- Midstream (Transportation & Storage)

- Downstream (Refining, Marketing & Distribution)

By Resource Type

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

By Extraction Technique

- Conventional Drilling

- Unconventional (Shale, Tight Oil, Oil Sands)

- Offshore Drilling

- Onshore Drilling

By End Use

- Power Generation

- Industrial

- Transportation

- Residential & Commercial

- Petrochemical Manufacturing

By Deployment Type

- Onshore

- Offshore

- Subsea

By Technology

- Seismic Imaging & Surveying

- Enhanced Oil Recovery (EOR)

- Hydraulic Fracturing

- Horizontal Drilling

- Remote Monitoring & Automation

- AI & Predictive Maintenance

By Distribution Channel

- Direct Supply

- Third-Party Vendors

- Oilfield Services Companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5739

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.